Climate, Energy & Environment

Kariuki Ngari Named CEO Africa at StanChart

Kariuki Ngari’s nomination heralds a new chapter and an entire volume in the bank’s narrative of success in Africa. It signifies a renewed sense of purpose, a reaffirmation of values, and a shared commitment to shaping a brighter future for the continent’s economies and communities.

Standard Chartered appoints Kariuki Ngari as CEO Africa, highlighting its commitment to digital growth and financial inclusion.

In a major leadership shift, Kariuki Ngari was appointed CEO Africa at Standard Chartered Bank, effective April 3, 2024. The move signals the bank’s strategic pivot toward deepening its African footprint while capitalizing on Ngari’s extensive banking expertise.

“Ngari’s appointment is a vote of confidence in African leadership and signals a renewed focus on innovation, inclusion, and regional expansion.”

Challenges and Opportunities

✅ Navigating Regulatory Complexity

Africa’s diverse regulatory regimes present a complex landscape. Ngari must balance compliance with growth by customizing approaches for each country, ensuring that Standard Chartered’s operations align with local laws while staying agile.

✅ Adapting to Market Dynamics

African markets are constantly evolving—marked by shifting consumer trends, tech innovation, and fierce competition. Ngari will need to respond swiftly to trends, especially in digital banking and fintech.

✅ Expanding Financial Inclusion

With millions unbanked, Ngari’s leadership is crucial for promoting financial literacy, banking access, and inclusive economic development. These align with Standard Chartered’s sustainability and impact goals across the continent.

Track Record of Excellence

📱 Championing Digital Banking

Ngari has led digital transformation within Standard Chartered Kenya, launching customer-centric platforms like the SC Mobile App and expanding self-service banking across African markets.

🌍 Growth Across Borders

He has spearheaded successful market entries and expansion projects, increasing the bank’s share in high-potential markets like Nigeria, Uganda, and Ghana.

♻️ ESG and Sustainability Advocate

Ngari has been at the forefront of integrating Environmental, Social, and Governance (ESG) principles into Standard Chartered’s business model, including climate finance and community support initiatives.

What Stakeholders Expect

- Strategic Vision: Stakeholders expect Ngari to articulate a bold, Africa-specific strategy rooted in opportunity and sustainability.

- Innovation Focus: Digital transformation will remain a cornerstone under his leadership.

- Stakeholder Collaboration: Ngari is expected to deepen ties with regulators, investors, and communities across Africa.

Why the Appointment Matters

- Homegrown Leadership: Ngari, a Kenyan national, brings regional insight and credibility, showing the bank’s confidence in local leadership.

- Continuity and Vision: With deep roots in the bank, Ngari ensures a seamless transition and strong alignment with Standard Chartered’s global ambitions.

- Commitment to Africa: The move underscores Africa’s significance in the bank’s international strategy, especially under the AfCFTA trade framework.

“Kariuki’s rise isn’t just a leadership change—it’s a clear signal that Standard Chartered sees Africa as central to its future,” said a Nairobi-based analyst.

Looking Forward: A New Era of Growth

Kariuki Ngari is now at the helm of shaping Standard Chartered Africa’s next growth phase. From promoting digital financial inclusion to unlocking cross-border capital flows, his tenure could redefine how the bank engages with Africa’s fast-changing economies.

He takes on this challenge not only with experience—but with purpose.

“Ngari’s nomination heralds a new chapter of innovation, resilience, and inclusive banking across Africa.”

🔑 Keywords:

Kariuki Ngari, Standard Chartered Bank, CEO Africa, Financial Inclusion, Digital Transformation, ESG, Africa Banking Sector, Banking Leadership

Let me know if you’d like a caption, summary card, or LinkedIn-optimized intro for this piece.

Renewable Energy & Access

Kenya Court Halts $2B Lamu Coal Project

The 1,050MW Lamu coal plant faced a decade of opposition from environmental groups and UNESCO advocates. The verdict now strengthens Kenya’s clean energy transition.

Kenya’s High Court halts a $2 billion Lamu coal plant near a UNESCO site, citing environmental and heritage violations.

NAIROBI, Oct. 17 — Kenya’s High Court has blocked construction of the proposed $2 billion Lamu coal plant, citing serious environmental and social concerns. The ruling delivered virtually from Malindi by Justice Francis Mwangi Njoroge on October 16, 2025, is a major victory for activists and local residents who have fought the project for years.

The 1,050-megawatt facility, planned for Kenya’s historic Lamu County, where al-Shabaab militants are threatening a $ 25 billion Lamu Port-South Sudan-Ethiopia -Transport (LAPSSET) corridor project,was to be the country’s first coal-powered station. However, the court found that the developers failed to conduct proper public participation and environmental assessments before securing government approvals.

“The approval process lacked meaningful engagement with affected communities,” Justice Njoroge said. “The constitutional right to a clean and healthy environment must take precedence over economic ambition.”

A Decade of Controversy

The project was led by Amu Power Company Ltd, a consortium majority-owned by Centum Investment Co. Plc — one of Kenya’s largest investment firms. Other key partners included Gulf Energy Ltd and China Power Global, which was expected to handle engineering and construction under the $2 billion deal.

Since its inception in 2015, the Lamu coal plant has faced intense opposition. Local fishermen, conservationists, and global environmental organizations such as Greenpeace Africa and Natural Justice warned that the plant would damage marine ecosystems and pollute air quality. The site lies close to Lamu Old Town — a UNESCO World Heritage Site — which risked losing its protected status if construction went ahead.

In 2019, the National Environment Tribunal (NET) suspended the plant’s environmental license, ruling that the environmental review had been flawed. Amu Power appealed the decision, but the project stalled as government policy began shifting toward cleaner energy sources.

Kenya’s Energy Shift

Kenya’s energy mix has changed dramatically over the past decade. As of 2024, Kenya Power reports that 86% of electricity comes from renewable sources such as geothermal, hydro, wind, and solar.

The Lamu coal project was originally conceived to provide cheap, reliable energy for industrial users. Yet falling renewable costs and international climate pressure have made coal both economically and politically unviable.

“Coal no longer fits Kenya’s green growth agenda,” said Joseph Njoroge, former Principal Secretary for Energy. “The economics simply don’t add up, and the environmental cost is too high.”

In 2022, the Ministry of Energy and Petroleum reaffirmed Kenya’s commitment to 100% clean energy by 2030, aligning with the Paris Agreement and national Vision 2030 goals.

Impact on Investors and Communities

The court’s ruling carries deep implications for both investors and local livelihoods. Centum’s subsidiary, Amu Power, had already invested around KSh 3.2 billion ($21 million) in feasibility studies, design work, and land acquisition.

A company spokesperson said Amu Power was “reviewing the judgment and considering its legal options.”

For Lamu residents, however, the decision was cause for celebration.

“This is not just a win for Lamu—it’s a win for all Kenyans who believe development must respect people and planet,” said Omar Elmawi, coordinator of the DeCOALonize Coalition, which led local resistance efforts.

Human rights groups, including Amnesty International Kenya and the Kenya Human Rights Commission, welcomed the verdict, urging the government to compensate families affected by earlier land acquisitions. They also called for the redirection of public investment toward renewable infrastructure in coastal Kenya.

A Turning Point for Green Governance

Experts believe the Kenya court ruling could reshape how African countries balance industrialization with environmental responsibility.

“Kenya’s courts are increasingly defining the country’s sustainable development trajectory,” said Dr. Wanjira Mathai, Managing Director for Africa at the World Resources Institute. “This judgment shows that rule of law and green growth can advance together.”

The High Court decision effectively voids the Lamu plant’s environmental license. Any attempt to revive the project would require a fresh environmental review and new public consultations — a process expected to take years.

For now, the ruling positions Kenya as a continental leader in renewable energy governance. It also signals to international investors that environmental accountability is no longer optional in Africa’s infrastructure landscape.

Climate, Energy & Environment

U.S. Backs 1-Year AGOA Extension Amid Trade Strains

The Trump administration’s tariff hikes have eroded AGOA’s benefits. A short-term extension may not be enough to restore African confidence.

U.S. supports a 1-year AGOA extension; African exporters may suffer amid tariffs and tight deadlines for renewal.

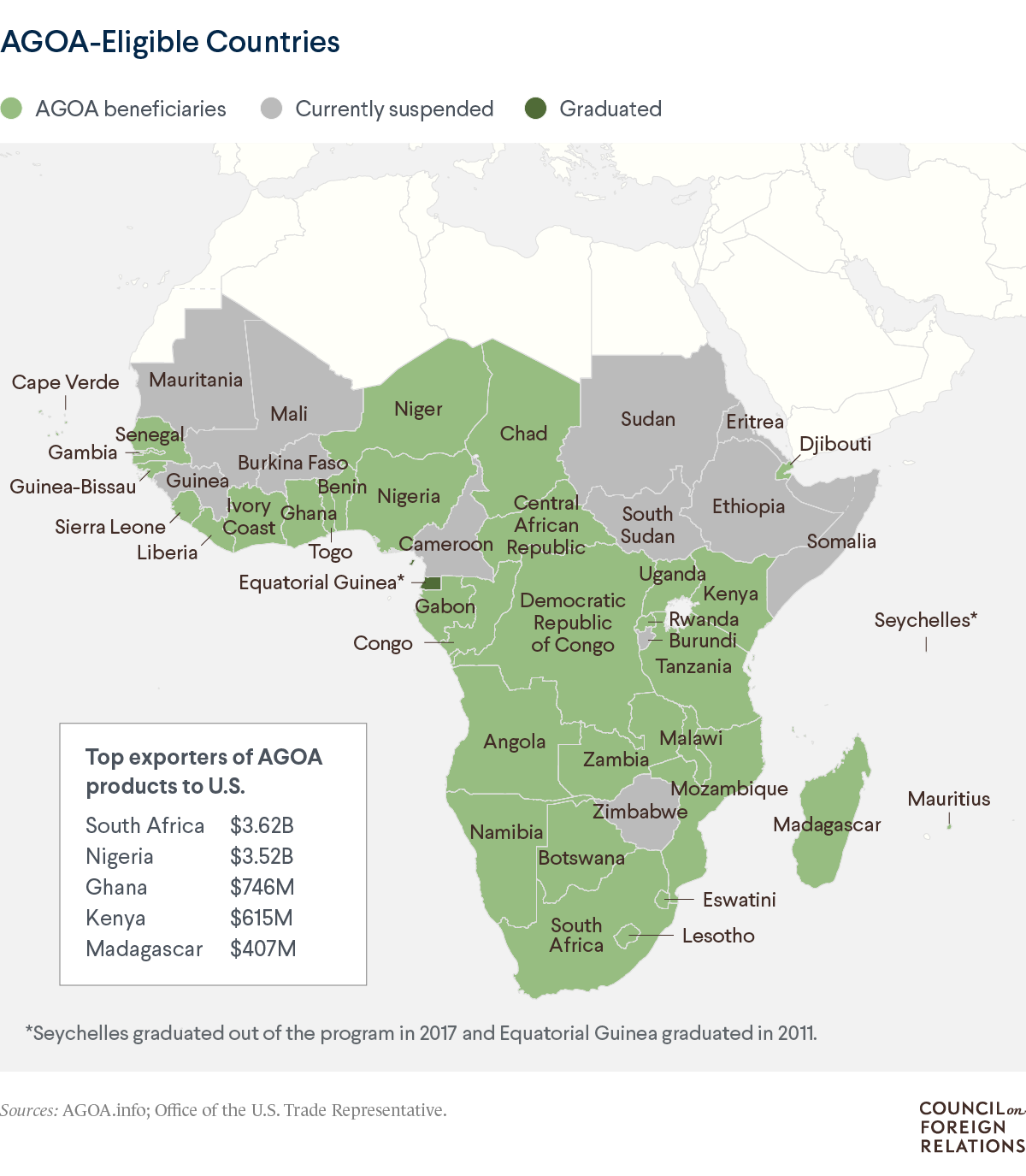

A senior White House official confirmed that the Trump administration supports a one-year extension of the African Growth and Opportunity Act (AGOA), which is set to expire at the end of the month. While the move offers some reassurance to African exporters, significant uncertainty remains over whether Congress will act in time.

Trade flows underscore the stakes

U.S. trade with Africa has been rising: in 2024, total goods trade reached roughly $72 billion, with exports to Africa at $32.4 billion and imports at $39.6 billion, according to the U.S. Trade Representative’s office. The trade deficit stood at about $7.2 billion.

Under AGOA specifically, U.S. imports from beneficiary countries dropped to about $8 billion in 2024, down from $9.3 billion in 2023, according to a Congressional Research Service note. In 2023, imports under AGOA totaled nearly $9.7 billion, led by crude oil ($4.2 billion), apparel ($1.1 billion) and agricultural products, data from the Center for Global Development shows.

These figures illustrate how much is now at risk if AGOA were allowed to lapse.

Background: a pact under pressure

First enacted in 2000 under President Bill Clinton, AGOA grants eligible sub-Saharan African countries duty-free access to the U.S. market across many product lines. Over the decades, it has become a primary vehicle of U.S.–Africa economic engagement.

However, that preferential access has been eroded by the Trump administration’s unilateral tariffs—ranging from 10 percent to 30 percent—on several African exports. These measures have muted AGOA’s advantages, creating distrust among beneficiary nations.

Supporters argue AGOA has sustained hundreds of thousands of jobs in over 30 countries and served as a counterbalance to China’s rising presence in Africa.

Renewal prospects and obstacles

Despite White House backing, the window for Congress to renew AGOA is narrow. Leaders anticipate its extension may need to ride on a stopgap funding bill, a common legislative strategy for time-sensitive measures.

Still, internal divisions complicate that path. Some U.S. lawmakers question AGOA’s long-term efficacy and fairness, especially in a climate where tariffs have distorted the original benefits.

From the African side, pressure is intensifying. Delegations from Kenya, Lesotho, South Africa and others have urgently lobbied lawmakers and trade officials to act. Lesotho’s trade minister warned that delays could cost garment sector jobs.

South Africa’s trade minister, Parks Tau, voiced cautious optimism, noting bipartisan support in Congress but suggesting any extension is likely to be short (one to three years) to allow for later reforms. Tau is also in talks with U.S. officials over tariff relief on South African exports hit by 30 percent duties.

Consequences of lapse

If AGOA expires—even temporarily—analysts forecast sharp harm to sectors such as apparel, metals, chemicals, and agriculture. The International Trade Centre estimates Lesotho’s clothing exports could fall by nearly 29 percent, while South Africa’s car exports might shrink 23 percent by 2029.

Countries like Kenya, Tanzania, Madagascar, and Eswatini are also seen as particularly vulnerable. Some firms already say they are cancelling U.S. orders or pivoting to alternative supply chains, according to Business of Fashion.

Beyond the economic toll, a lapse in AGOA would represent a diplomatic setback for the U.S. in Africa—particularly as China and others deepen their trade and investment presence across the continent.

The road ahead

A multiyear renewal seems unlikely in the short term. A one-year extension is the most politically feasible option under current constraints. Still, such a stopgap would not fully restore trust or correct structural distortions caused by recent tariffs.

Which way Congress leans—and whether it can build bipartisan momentum quickly—will determine whether AGOA endures, is reshaped, or quietly disappears. Time is ticking.

Renewable Energy & Access

Ethiopia Signs Nuclear Energy Agreement with Russia to Develop Power Plant

If completed, Ethiopia will become the second sub-Saharan African nation with nuclear power. Experts say the Ethiopia-Russia deal could serve as a model for Africa’s clean energy transition.

On September 25, Ethiopia signed a nuclear energy deal with Russia in Moscow, aiming to diversify power sources, build local expertise, and boost regional energy security.

Ethiopia Signs Landmark Nuclear Energy Deal with Russia to Diversify Power Sources

Ethiopia took a historic step on September 25, 2025, by signing a nuclear energy cooperation agreement with Russia in Moscow. The deal, formalized during a nuclear energy forum, involves the construction of a nuclear power plant in Ethiopia and represents a major leap in the country’s energy strategy. Ethiopian Electric Power CEO Ashebir Balcha and Rosatom CEO Aleksei Likhachev signed the comprehensive action plan, highlighting the nations’ commitment to collaboration in energy technology and infrastructure.

Strategic Significance for Ethiopia

The agreement outlines a roadmap for building the nuclear facility, covering technical planning, financing, and the creation of a Nuclear Science and Technology Center in Ethiopia. The deal also includes training Ethiopian personnel in nuclear operations to develop domestic expertise. For Ethiopia, this project marks a critical step toward diversifying its energy mix beyond hydropower, solar, and wind.

Prime Minister Abiy Ahmed emphasized the importance of the initiative: “Nuclear technology provides reliable, low-emission power, strengthens food security, optimizes water management, and empowers our scientists.” He added that Ethiopia’s rapidly growing economy and population of over 130 million demand a diversified energy portfolio. Current investments, including the Grand Ethiopian Renaissance Dam (GERD), are not sufficient to meet future energy needs.

The Deal’s Scope and Capacity Building

Under the agreement, Rosatom will assist Ethiopia in constructing the nuclear power plant while building local technical capacity. Ethiopian engineers and technicians will receive specialized training in nuclear science, safety protocols, and operations. This ensures that the project does not only generate power but also strengthens Ethiopia’s scientific and technological base.

Ashebir Balcha, CEO of Ethiopian Electric Power, said: “This nuclear facility is more than energy generation; it’s about building knowledge, capacity, and innovation for Ethiopia’s future.” The initiative positions Ethiopia to emerge as a regional hub for advanced energy technology.

Regional and Continental Implications

If completed, Ethiopia would become only the second sub-Saharan African country after South Africa to operate a nuclear power plant. This milestone would demonstrate Africa’s capacity to adopt advanced, low-carbon energy solutions and could serve as a blueprint for other nations facing surging energy demand.

For example, this May, neighbouring Kenya signed a $1b renewable energy deal positioning itself as Africa’s green leader.

Energy analysts highlight that Ethiopia’s growing population, urbanization, and industrialization require a resilient energy system. According to the World Bank, electricity demand in Ethiopia is projected to double over the next decade. Nuclear energy, with high reliability and low greenhouse gas emissions, offers a sustainable solution to meet this demand.

The development also has broader geopolitical implications. By partnering with Russia, Ethiopia strengthens strategic ties while signaling its intention to diversify energy sources and reduce dependence on a single energy type. The project enhances regional energy security, providing a potential model for neighboring countries in East Africa.

Risks and Challenges

Despite the promise, nuclear energy projects are complex, expensive, and politically sensitive. Ensuring safe operations, adhering to international safety standards, and securing consistent funding are critical for the project’s success. Ethiopia must also manage public perception and regional concerns over nuclear proliferation, while demonstrating transparency and regulatory compliance.

A Vision for Sustainable Energy

The Ethiopia-Russia nuclear partnership represents a forward-looking approach to energy security. Combined with hydropower, solar, and wind, nuclear energy will contribute to a diversified, sustainable power system capable of supporting economic growth, innovation, and social development.

Prime Minister Abiy Ahmed stressed: “The nuclear deal is a strategic investment in our nation’s human capital, technological capacity, and future prosperity.” By integrating nuclear power, Ethiopia sets a precedent for the continent, showing that African nations can safely and effectively adopt advanced energy solutions to meet rising demand.

Explore further: Rosatom | Ethiopian Electric Power | Grand Ethiopian Renaissance Dam | South Africa Nuclear Program

-

Politics, Governance & Regional Affairs6 days ago

Politics, Governance & Regional Affairs6 days agoRaila Odinga’s Death Tests ODM Unity

-

Celebrities, Creatives & Public Figures7 days ago

Celebrities, Creatives & Public Figures7 days agoCaptain John Kiniti: Kenya’s First African Pilot

-

Regional Security & Peacebuilding7 days ago

Regional Security & Peacebuilding7 days agoKabila’s Nairobi Meeting Deepens DRC–Kenya Rift

-

Banking, Finance & Economic Policy4 days ago

Banking, Finance & Economic Policy4 days agoMacharia to Lead Sidian Bank’s Revival

-

Celebrities, Creatives & Public Figures5 days ago

Celebrities, Creatives & Public Figures5 days agoWPP-Scangroup Names Owusu-Nartey as CEO

-

Banking, Finance & Economic Policy6 days ago

Banking, Finance & Economic Policy6 days agoKenya Banks Poised for Strong Q4 Rebound

-

Human Rights & Social Justice7 days ago

Human Rights & Social Justice7 days agoRwanda Targets Exiled Critics with Sanctions

-

Banking, Finance & Economic Policy5 days ago

Banking, Finance & Economic Policy5 days agoEthiopia Caps Foreign Bank Ownership at 49%